Learn more about the various types of later life lending plans available to homeowners over the age of 50

The most popular equity release scheme. Learn about how they work and the range of flexible plans available.

Lifetime mortgages that allow you to release tax-free cash as a single lump sum payment. Learn more here.

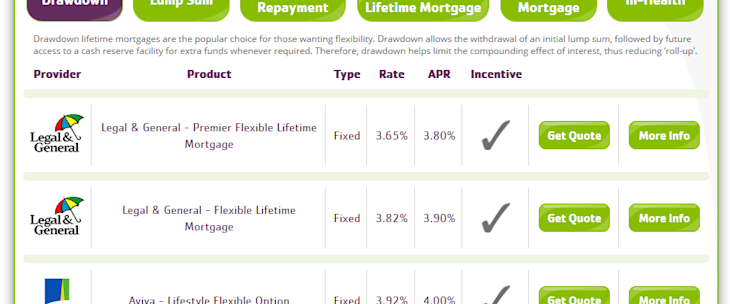

Drawdown is the most popular lifetime mortgage. A flexible cash reserve allows you to receive money in smaller amounts.

Lifetime mortgage where regular interest repayments help control the final balance to be repaid. Learn how they work.

Health conditions can improve the offer from your lender. Learn how you could borrow more, or lower your rate here.

Make ad-hoc repayments which can help manage your final balance to be repaid. Learn how these lifetime mortgages work.

You could release money from your buy-to-let investment portfolio. Information and qualifying criteria on these lifetime mortgages here.

You can release money from your second or holiday home. Learn how these lifetime mortgages work.

This equity release scheme involves selling a percentage of your home. Learn how home reversion schemes work here.

Mortgages that continue into retirement based on income and affordability. Require monthly interest and or capital repayments. More details here.

RIO Mortgages continue into retirement based on income and affordability. Require monthly interest only repayments. Learn how they work.